Last month more than 12,000 delegates descended on Miami for the 2021 Bitcoin Conference. This year’s event attracted six times the number who attended the 2019 event. With luminaries ranging from Twitter and Square CEO, Jack Dorsey, to libertarian icon, Ron Paul, in attendance, it begs the question, ‘Have digital assets finally come of age?’

Finally? Cryptocurrencies and digital assets have actually been around for several decades. Most people think of Bitcoin as the starting point but as I wrote back in December 2020: –

Since the Great Financial Crisis in 2008, cryptocurrencies have come of age. The advent of Bitcoin in 2009 is often thought to have been the beginning of cryptocurrencies, but as early as 1983, American Cryptographer David Chaum had invented the blinding formula, an extension of the RSA algorithm which is still used today for web encryption. Chaum went on to create DigiCash in 1989.

The backbone of modern cryptocurrencies is distributed ledger technology (DLT), which developed out of the public key infrastructure of the early 1990’s. There are numerous reasons why it took so long for cryptocurrencies to gain traction, but the financial crisis of 2008 was undoubtedly a catalyst. It was a crisis of trust; trust in the banking system, trust in the honesty of public institutions, trust in the value of fiat money itself. In the aftermath of the crisis, gold, along with other stores of value, rose in price, but Bitcoin, endowed with anonymity and a finite money supply, captured the imagination of a new generation of investors for whom gold was a technologically barbarous relic.

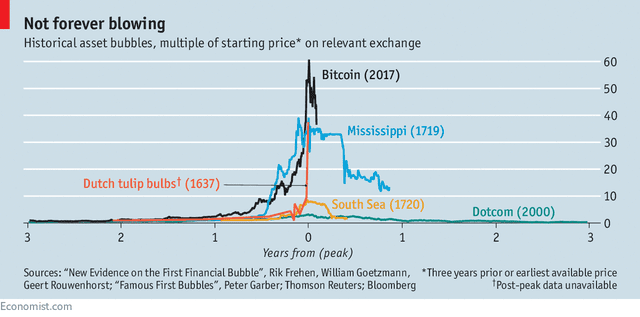

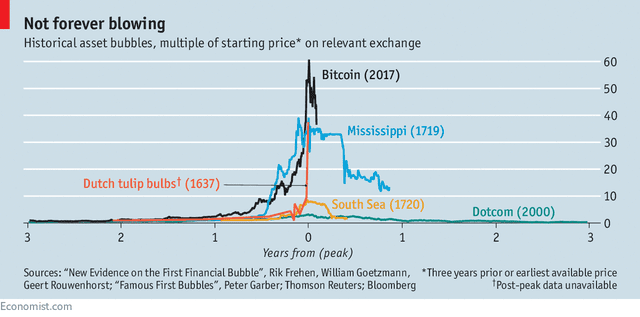

During the last five years Bitcoin has gained prominence. A rally in 2017 led to comparisons with some of the great asset bubbles in history. This chart, taken from a January 2018 Economist article, sets the scene: –

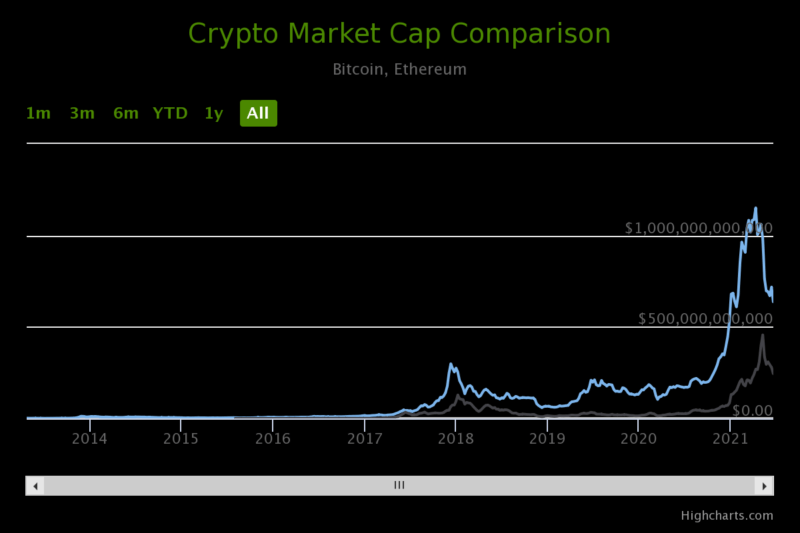

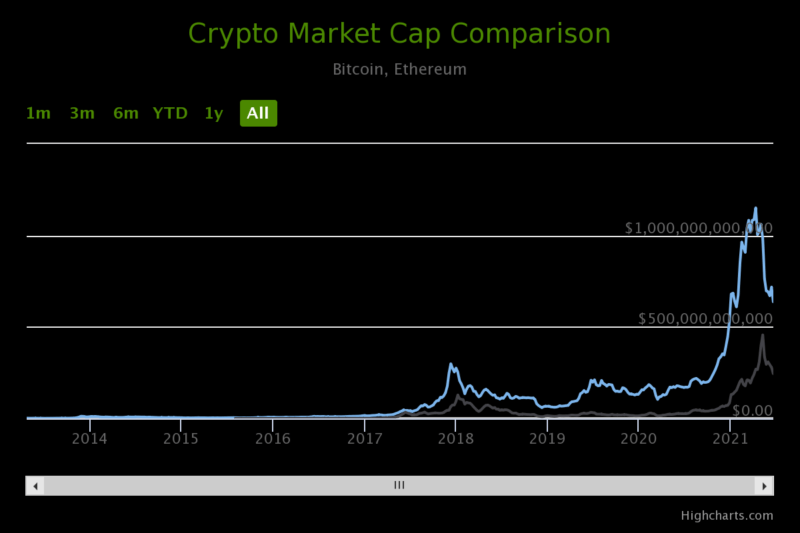

Unlike tulips, however, the price of Bitcoin has been resurgent and a second digital asset, Ether, has now captured more than a third of the market: –

Total digital asset market capitalization, even after the recent correction, stands at $1.35trln (22nd June). The Crypto Winter of 2018 to 2020 gave way to a broader based glorious summer, although the chart above suggests autumn may have arrived with the solstice this year.

During the intervening three years since the first speculative frenzy, many aspects of the digital asset marketplace have evolved. Regulators, eager not to be left behind, have begun to impose controls aimed at protecting investors. Meanwhile central bankers have announced the creation of their own digital assets – Central Bank Digital Currencies (CBDC) – for more on this topic please see my December 2020 article.

In the last month, China, which has been in the vanguard of CBDC development, announced a ban on financial institutions and payment companies from providing services related to cryptocurrency transactions; they also warned investors against speculative crypto trading. The ban is not new, merely an extension of restrictions first imposed in 2017. Institutions are no longer permitted to accept digital currencies for payment or settlement, nor can they provide exchange services between cryptocurrencies and the yuan or foreign currencies. Saving, fiduciary pledging services and crypto-related financial products are also prohibited.

China’s actions need to be viewed in a wider context. Across the globe, just five countries have declared digital currencies illegal and only 15, including China, Russia and Canada, have imposed some form of banking restriction. India currently has no restrictions, but the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 was introduced in the spring to slow adoption and protect investors. For undisclosed reasons, no action has yet been taken but uncertainty remains. It is heartening to note, therefore, that no restrictions exist in the EU or any G7 country, although environmental concerns remain over the carbon footprint of Bitcoin especially. A recent leader in the Economist – Can bitcoin be bettered? explains: –

…the mechanism bitcoin uses to verify transactions and put new coins into circulation, known as “proof of work” (POW). In periods of high activity, as witnessed during much of 2021, bitcoin burns more energy than the whole of Argentina. The glaring inefficiencies of that process also explain why payments in bitcoin are slow and costly, and thus a rarity. That has fed appetite for alternative mechanisms, the most popular of which is dubbed “proof of stake” (POS). Ether, the second-most popular cryptocurrency after bitcoin, is preparing to switch to it; smaller coins already use it.

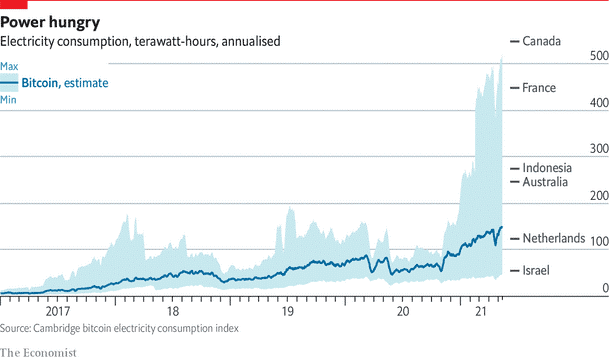

This chart is also revealing: –

The recent correction in the price of digital assets may be partly a response to the threat of a Chinese ban but it is more likely due to a wave of profit-taking after an exceptionally strong run, fueled, at least in part, by the monetary and fiscal pump-priming of central banks and governments in response to the Covid-related economic shock.

Digital Institutionalization

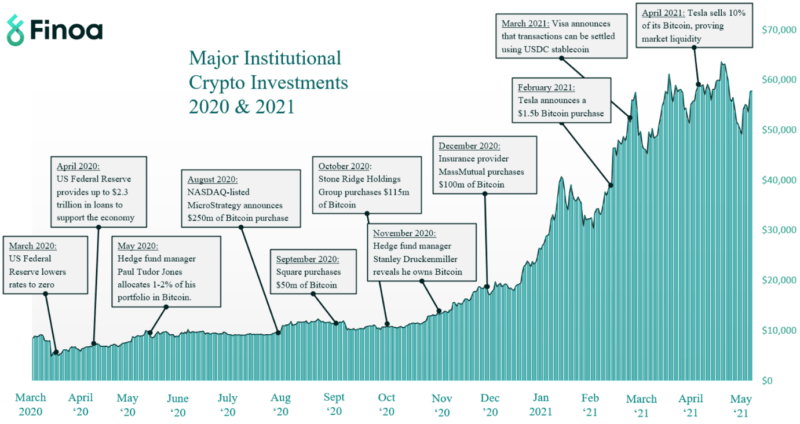

Looking beyond the short-term gyrations in cryptocurrency prices, however, digital asset markets have broadened and deepened. A number of high profile institutions have invested in the sector. In June of last year a survey from crypto-custodian, Fidelity Digital Assets, revealed 36% of US and European institutional investors had already allocated to the space. Hedge funds led the charge, but in December 2020, insurance giant Massachusetts Mutual announced that it had allocated $100mln to Bitcoin. Meanwhile, across the pond, mainstream UK asset manager Ruffer declared a £550mln allocation. The chart below, from digital exchange operator, Finoa, shows some of the highlights from the past 18 months: –

Not shown in the chart above is the official decision taken by Goldman Sachs to start offering a digital asset service to their customers. Rumors they were about to enter the market, back in May 2018, were quickly denied as the Crypto Winter began; however, since May 2021 they have been facilitating derivative transactions. Other mainstream operators starting to offer digital asset products include Cowen and Standard Chartered. Meanwhile global custodian BNY Mellon has backed Fireblocks, a leading crypto-custodian.

Whilst Bitcoin remains the largest digital asset by market capitalisation, its performance this year has been eclipsed by a widening array of challengers. There are now more than 80 digital assets with a market capitalization in excess of $500mln. Of these, only nine underperformed Bitcoin year to date (22st June). The snap-shot below (taken at 14:00 UK time on 22nd June) shows the ten largest digital assets by market capitalization; they include stablecoins, which are tightly tied to the price of the US$: –

According to Coingecko.com, a digital asset service provider, there are some 8,036 coins and 476 recognized exchanges offering both Spot and Derivatives. It is worth mentioning that the total volume of derivative transactions is normally higher than that for deliverable Spot transactions – on a fairly average day, 21st June, it exceeded $200bln. To facilitate the dramatic growth in institutional volume over the past year, exchanges and other technology providers have introduced a range of additional security services including crypto-custody, of which there are now more than 100 providers.

Asset managers have also been quick to respond to demand, offering a range of investment vehicles. The simplest products, many of which are now available as exchange-traded-funds on conventional stock exchanges, track individual coins or baskets of coins. One of the largest offerings is the Grayscale trusts, which provide new institutional investors with access via private placements – their latest reported AUM (31st March) was $40.3bln.

Other investment products take a long-only discretionary approach, attempting to provide a similar upside with lower volatility. Then come the venture-capital funds, investing in both coins, other digital assets and traditional private or public equities of the multitude of startup companies involved in the industry.

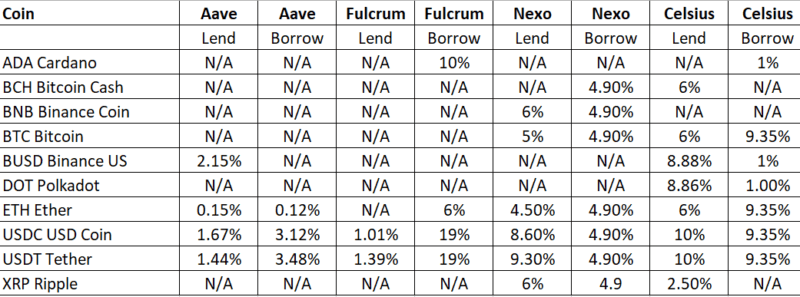

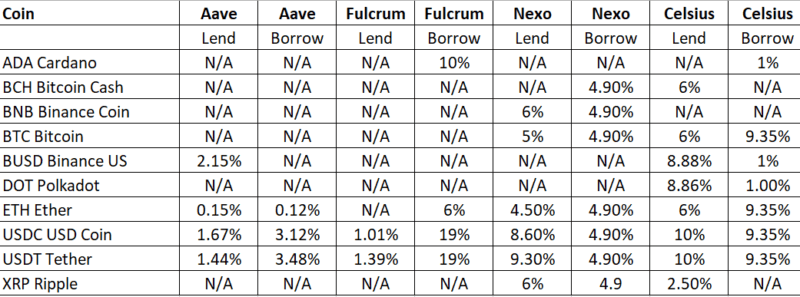

The final category are the hedge funds which invest both long and short, taking advantage of asset appreciation and arbitrage opportunities, including inter-exchange arbitrage, basis trading between Spot and Derivative exchanges and yield-harvesting through asset lending programmes. There is an active borrowing and lending market for digital assets and the yields available, even for Stablecoins, which are linked to the price of fiat currencies, can be considerable. The rates below were taken at 14:30 UK time on 22nd June: –

The lack of pricing and variability between venues and in the wide variations in the spread between the bid and offer is a clear indication of the nascent nature of the current market. However, in a world where fiat interest rates, for the world’s principal currencies, hover close to the zero bound, these interest rates are interesting. Caveat emptor, this is not a free lunch; the interest rates are a function of borrowing demand from highly leveraged market participants and the credit risk associated with different exchanges, platforms and technologies. During periods of high demand – usually when digital asset prices are rising and leveraged borrower demand is high – rates can briefly soar in much the same way that the stock-loan price of the acquirer’s stock increases during a high-profile merger. The marketplace is fragmented and inefficient but the potential rewards are clear.

My recent research has identified more than 1,200 active hedge funds, the majority of which remain unregulated. The number of funds which have closed since the previous bubble in 2017 is almost as high but with the new bubble have come new entrants, many of which are sophisticated, seasoned financial market professionals seeking institutional customers. They are building well-managed products designed to attract the discerning investor, and their focus is on risk-management and drawdown control. The objective? Better risk-adjusted returns.

Just when you thought it was safe to go back in the water

During the past month, digital asset markets have reminded investors that what goes up can come back down even faster. Bitcoin as a means of exchange remains too volatile for widespread adoption; as a store of value it has its advocates, but for the majority of investors it remains a highly speculative investment.

Setting aside the volatility of the majority of digital assets, there are constraints on adoption imposed by the underlying decentralized and permissionless nature of distributed ledger technologies. The cost of transactions, based on proof of work verification, which requires increasingly onerous computational (and energy) resources, imposes a limit on the number of transactions which can be processed in a given time. Regardless of the carbon footprint, the current architecture remains limited.

Solutions are in train which will increase the speed and transactional capacity of the digital asset marketplace. The constant stream of venture capital flowing into the industry bodes well for the future. Meanwhile, despite the bottlenecks mentioned above, the industry is rapidly becoming institutional in its approach. Leading participants have generally welcomed regulation and oversight as it lends them official legitimacy.

A nagging doubt remains. Why would any government willingly cede sovereignty over the issuance of currency to disruptive challengers? Here I believe the regulators have already shown their hand. From a regulatory perspective, digital assets are regarded as either commodities (regulated by the CFTC) or securities (the purview of the SEC), none are considered to be currencies in their own right, even though officials discuss some of them, such as Bitcoin, as if they were.

China, along with other totalitarian regimes, may seek to outlaw their use, but prohibition does not eradicate ownership; it simply drives it underground. In more open and developed democratic countries, I believe, digital assets will become increasingly regulated and legitimized, but that doubt remains. This week the BIS – CBDCs: an opportunity for the monetary system– provided an update on the advantages of CBDCs. Among their conclusions, these remarks suggest that investors should adopt a cautious approach: –

Central banks stand at the centre of a rapid transformation of the financial sector and the payment system. Innovations such as cryptocurrencies, stablecoins and the walled garden ecosystems of big techs all tend to work against the public good element that underpins the payment system…

CBDCs represent a unique opportunity to design a technologically advanced representation of central bank money, one that offers the unique features of finality, liquidity and integrity.

Back in 2016 I attended a lecture at which a highly respected economist denounced Bitcoin as, ‘Merely a means of exchange for the criminal underclass.’ During the intervening five years, much has happened to support the case for digital assets and this month a bipartisan bill, the Blockchain Innovation Act, requiring additional study on the use of blockchain technology and digital tokens, passed easily through the US House of Representatives. More legitimacy will be needed to satisfy the institutional investment community, but it is reasonable to conclude that digital assets have finally come of age.

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing – DONATE