As we expected, Evergrande is only the first cockroach.

With the world waiting to find out the fate of a $260 million bond issued by Jumbo Fortune Enterprises which is guaranteed by Evergrande, and which has no grace period so an event of default could take place as soon as this week (the bond has five business days to make payment subject to administrative and technical error), overnight, stocks and bonds of China’s heavily leveraged property tumbled after a failure by smaller developer Fantasia Holdings Group to repay notes deepened investor concerns about the sector’s outlook. The non-payment forced S&P to downgrade Fantasia (1777.HK) to selective default earlier this morning.

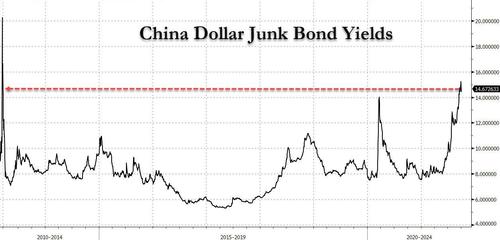

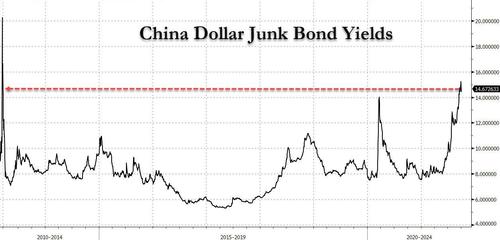

As Bloomberg points out, “Chinese junk dollar bonds were poised for their biggest selloff in at least eight years amid renewed concern that authorities will do little to alleviate the credit crisis gripping the industry.” Yields are near a decade high, and with Evergrande stock still halted, investors took out their wrath on peer developers who still trade and whose shares tumbled, with Sunac China Holdings and China Aoyuan Group falling at least 10%. Meanwhile, as noted on Sunday, Evergrande’s silence on a reported stake sale in a unit left its shares suspended.

The average price of China’s high-yield dollar bonds fell about 5 cents on the dollar, according to credit traders, set for the worst drop since at least 2013. Single B rated firms’ debt declined as much as 10 cents. Dollar bonds of Kaisa Group Holdings Ltd. and Modern Land China Co. were set for their biggest declines in at least a year, while a Central China Real Estate Ltd. bond lost almost 11 cents on the dollar.

The declines “shattered a period of calm” that had been spurred by speculation authorities would support the industry and limit damage to the economy. Chinese developer shares had rebounded 11% in the previous five days, the longest streak since March. after the central bank pledged to safeguard the real estate market and protect home buyers’ rights. The People’s Bank of China also added funds to the banking system for 10 straight days, pushing interbank borrowing costs lower.

The mood source on Monday after Fantasia Holdings Group – whose bonds had aggressively sold off in the past month – became the latest property company to fail to repay a $205.7 million maturing bond while a series of rating downgrades from global risk assessors and a slump in U.S. markets overnight added to investor jitters. Credit traders also blamed thin volumes for the scale of the meltdown with mainland China closed for a week-long holiday until Thursday and shutting off liquidity channels like stock links into Hong Kong and the central bank’s daily cash injections.

As Craig Botham, chief China economist at Pantheon Macroeconomics said, Fantasia’s missed payment “provides a clear sign that despite piecemeal bailouts of select Evergrande assets, property market stresses remain elevated.” He added that “the rot is unlikely to stop here.”

The silver lining is that Fantasia itself poses fewer risks to broader markets than Evergrande due to its smaller size: it ranked 60th in a list of contracted sales in the first quarter of this year versus third for Evergrande. Fantasia’s total liabilities were $12.9 billion as of June 30, according to the company’s first-half report, compared with $304.5 billion for Evergrande.

Separately, Country Garden Services Holdings said that a unit of Fantasia didn’t repay a 700 million yuan loan that also came due on Monday and that a default was probable.

Meanwhile, another developer, Sinic Holdings Group, saw its long-term issuer default rating was cut to C from CCC by Fitch, adding to the gloom. The Hang Seng Properties Index dropped as much as 2.2% on Tuesday after last week’s rebound.

China’s government is unlikely to ease its curbs on the property sector, despite the recent speculation, according to Nomura Holdings Inc.

“Beijing’s hawkish stance on the property sector remains intact,” Nomura analysts led by Ting Lu wrote in a note dated Monday. “We expect Beijing to maintain its property-related tightening measures and a rapid weakening of the property sector to deal a severe blow to headline GDP growth and government revenue.”

Meanwhile, amid the fireworks from various other issuers, Evergrande – which has been at the epicenter of investor concern – has yet to publish an update since halting shares pending an announcement on a “major transaction.” The company agreed to sell a majority stake in its property services unit to a Guangdong-based developer, Cailian reported on Monday, citing unidentified people. Last week, Evergrande agreed to sell a 20% stake in Shengjing Bank Co. to the local government in a deal that S&P Global Ratings said marked the first step toward solving Evergrande’s liquidity crisis.

A Bloomberg index of Chinese real estate stocks is trading at less than 0.4 times book value. That shows stock traders are applying a significant discount to the value of assets held by Chinese developers, currently near the largest in data going back to 2005.

Looking ahead it only gets worse: fifteen of the country’s most stressed property developers will have $2.1 billion in bond payments due this month, according to calculations by Citi, comprised mostly of coupons. If they somehow manage to avoid mass defaults, it only gets tougher in January when the bill is set to double as principal payments come due, indicating market stress may reach another maximum around that time.

Finally, the worst news is that the market contagion is starting to spread rapidly to the broader property market: overnight China reported that Shenzhen second-hand home sales crashed 80% y/y to just 1,765 units in September, the first sub-2,000 print in 12 years. Should Beijing fail to arrest this crash in the real-estate market, then all bets are off.

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing – DONATE