By Robert Hughes

Total housing starts fell to a 1.425 million annual rate in October from a 1.488 million pace in September, a 4.2 percent drop. From a year ago, total starts are down 8.8 percent. Total housing permits also fell in October, posting a 2.4 percent drop to 1.526 million versus 1.564 million in September. Total permits are down 10.1 percent from the October 2021 level.

Starts in the dominant single-family segment posted a rate of 855,000 in October versus 911,000 in September, a drop of 6.1 percent. That is the fourth consecutive month under one million and the slowest pace since May 2020. Starts are down 20.8 percent from a year ago (see first chart). Single-family permits fell 3.6 percent to 839,000 versus 870,000 in September, the fifth consecutive month under one million and the slowest pace since May 2020 (see first chart).

Starts of multifamily structures with five or more units decreased 0.5 percent to 556,000 but are up 17.3 percent over the past year, while starts for the two- to four-family-unit segment fell 22.2 percent to a 14,000-unit pace versus 18,000 in September. Total multifamily starts were off 1.2 percent to 570,000 in October, but still showing a gain of 17.8 percent from a year ago (see first chart).

Multifamily permits for the 5-or-more group dropped by 1.9 percent to 633,000, while permits for the two-to-four-unit category increased 10.2 percent to 54,000. Total multifamily permits were 687,000, down 1.0 percent for the month but up 10.6 percent from a year ago (see first chart).

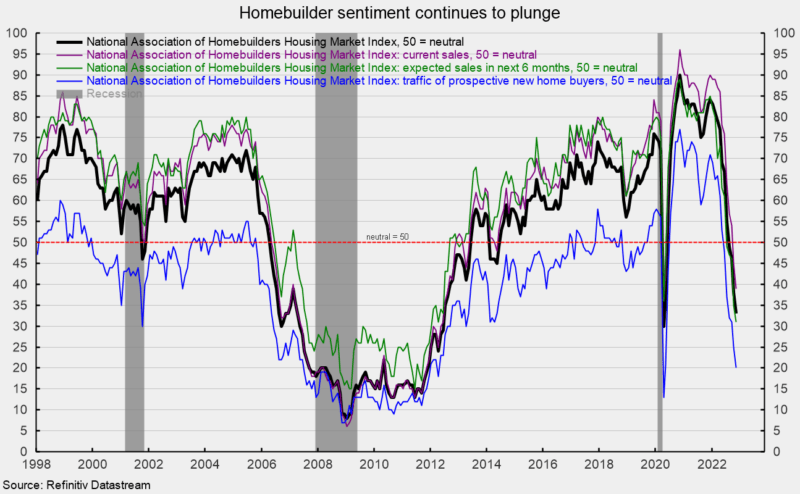

Meanwhile, the National Association of Home Builders’ Housing Market Index, a measure of homebuilder sentiment, fell again in November, coming in at 33 versus 38 in October. That is the eleventh consecutive drop and the fourth consecutive month below the neutral 50 threshold. The index is down sharply from recent highs of 84 in December 2021 and 90 in November 2020 (see second chart).

All three components of the Housing Market Index fell again in November. The expected single-family sales index dropped to 31 from 35 in the prior month, the current single-family sales index was down to 39 from 45 in October, and the traffic of prospective buyers index sank again, hitting 20 from 25 in the prior month (see second chart).

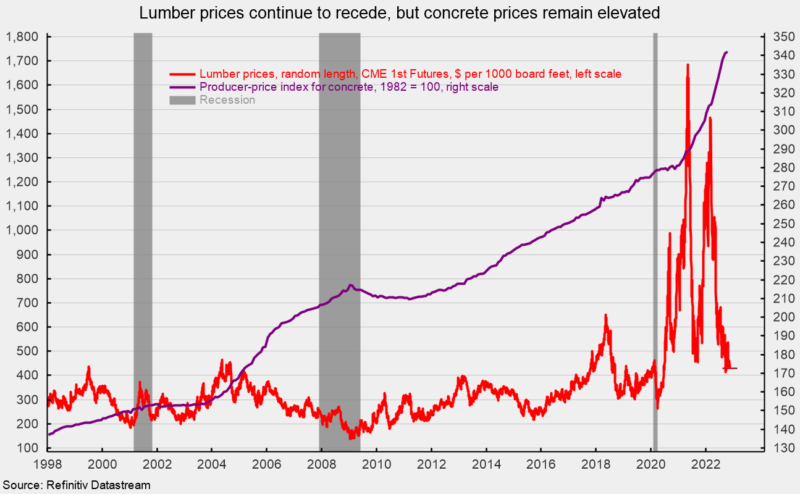

Input costs and supply delivery problems are still concerns for builders though lumber prices have declined sharply from recent highs. Lumber recently traded around $430 per 1,000 board feet in mid-November, down from peaks around $1,700 in May 2021 and $1,500 in early March 2022 (see third chart).

Mortgage rates continue to surge, with the rate on a 30-year fixed rate mortgage coming in at 7.08 percent in mid-November. Rates are up more than 400 basis points, more than double the lows in early 2021 (see fourth chart).

While the implementation of permanent remote working arrangements for some employees may have been providing continued support for housing demand, record-high home prices combined with the surge in mortgage rates and cautious consumer attitudes are reducing demand. Pressure on housing demand combined with elevated input costs is sending homebuilder sentiment plunging. The outlook for housing is unfavorable.

SOURCE

TELL YOUR FRIENDS ABOUT CITIZENS JOURNAL Help keep us publishing –PLEASE DONATE