By Mike LaFirenza

The U.S. economy today is in far better shape than it was at the onset of the COVID-19 pandemic two years ago. Unemployment is approaching pre-pandemic levels, GDP growth is up significantly, and many workers—especially lower earners—have seen a boost in wages, though the effect of this has been tempered by recent inflation.

Two years ago, the new pandemic and ensuing economic effects created much more uncertainty and fear in the economy, with spiking unemployment and entire sectors of the economy shutting down. In response, the federal government stepped in with unprecedented levels of financial relief to U.S. households and the economy in three major stimulus packages passed in 2020 and 2021.

One of the signature components of Congress’s economic relief efforts was a series of Economic Impact Payments made to U.S. households. Payment amounts and eligibility varied in each package, but most lower and middle income households received $3,200 per adult across the three payouts, with more for households with dependents. These payments were included to help households deal with lost jobs or wages as a result of COVID-related disruptions, and to help stimulate demand in the economy at a time when many industries were struggling.

U.S. Census survey data from July 2020, just a few months after the initial round of payments from the CARES Act, showed that the payments were a significant help to many households in covering regular living expenses. More than 60% of U.S. adults—more than 150 million people—used their stimulus checks to cover living expenses, far more than the share who paid off debt or simply saved the money. Given that much of the economy was shut down in the spring and early summer of 2020 and unemployment was still at historic highs, the additional relief from the federal government provided much-needed support for families who would have struggled to make ends meet otherwise.

|

Despite the success and popularity of the first round of stimulus payments in the CARES Act, subsequent rounds faced more criticism. These critics anticipated that with many parts of the economy performing better than expected, broad-based stimulus would give well-off households more money than they needed and potentially produce inflation. Some economic experts and policymakers instead argued for more limited, means-tested payments to the neediest households.

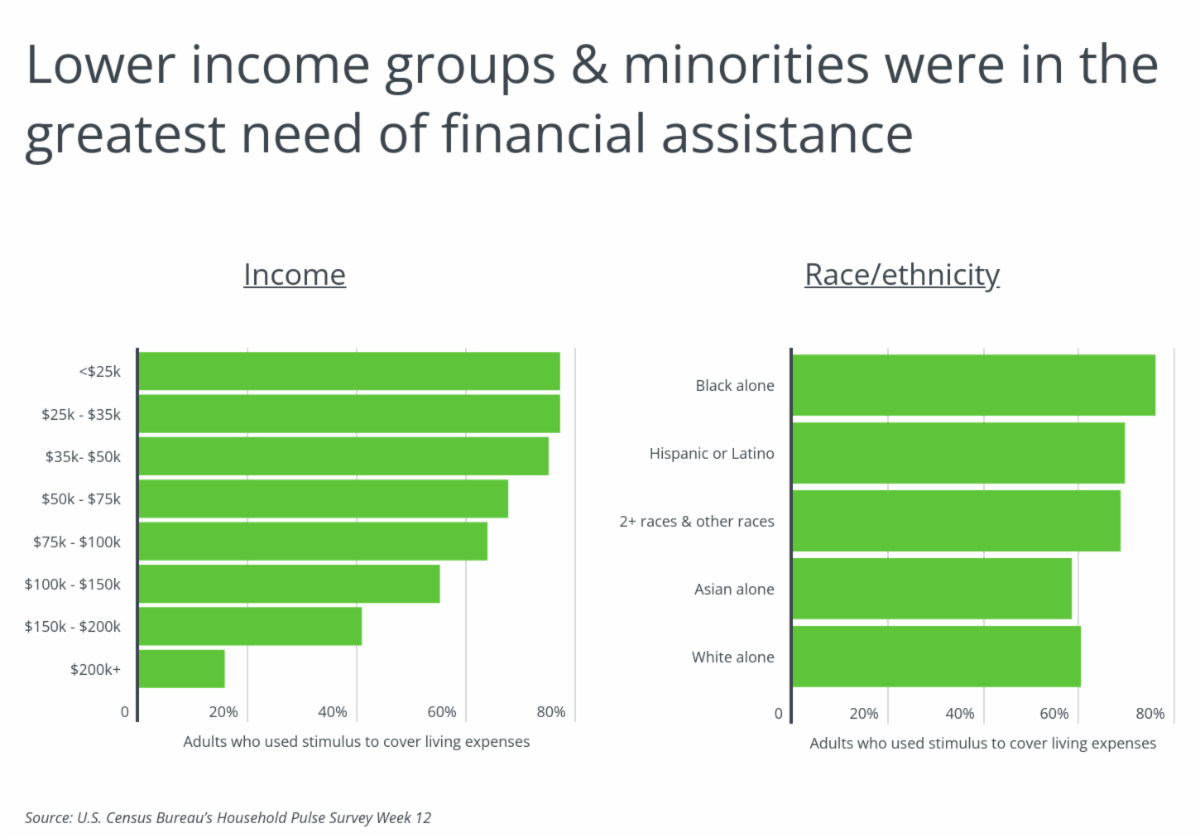

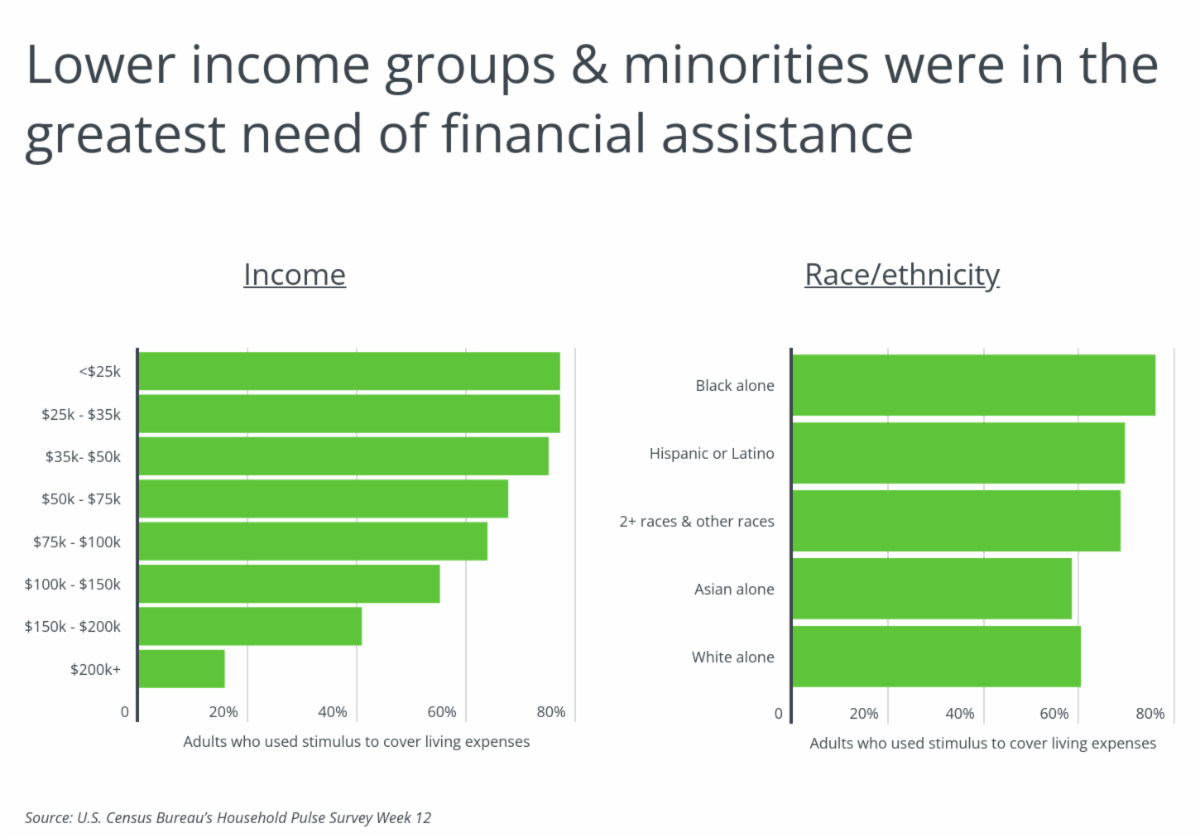

In retrospect, the Census survey data confirms that there were indeed significant differences between how more needy and less needy households used their stimulus payments. The households most likely to use their stimulus payments for living expenses were racial and ethnic minorities and low income earners. More than three quarters of Black adults (75.9%) reported using stimulus checks for living expenses, compared to just 60.3% of adults identifying as White alone. Differences were even starker along the income distribution: 77.1% of adults with household income below $35,000 used stimulus payments for living expenses, nearly five times the share for adults from households earning more than $200,000 (15.7%). These higher-income earners were more likely to pay debt, save money, or buy non-necessary items.

|

Given the demographic and economic trends in how stimulus payments were used, the Southern U.S.—which has a higher population of minority and low-income adults—saw the greatest share of adults using their checks for living expenses. Eight of the 10 states where the most adults used stimulus to cover living expenses are found in the South, including Louisiana (74.4%) and West Virginia (72.1%). At the metro level, Southern cities were also commonly among the locations where people covered living expenses with their payments, including four of the top five.

|

The data used in this analysis is from the U.S. Census Bureau’s Household Pulse Survey. To determine the locations where residents had to spend stimulus checks to get by, researchers at HireAHelper calculated the share of adults who reported using stimulus to cover living expenses. Researchers also included statistics on the share of adults using stimulus funds to pay off debt or add to savings.

The analysis found that in California, 62.9% of adults reported using stimulus payments to cover living expenses, while 10.3% reported using it for debt payoff, and 7.4% added the money to savings. Here is a summary of the data for California:

- Adults who used stimulus to cover living expenses: 62.9%

- Adults who used stimulus to pay off debt: 10.3%

- Adults who used stimulus to add to savings: 7.4%

- Adults who did not receive stimulus: 19.3%

For reference, here are the statistics for the entire United States:

- Adults who used stimulus to cover living expenses: 63.9%

- Adults who used stimulus to pay off debt: 12.0%

- Adults who used stimulus to add to savings: 9.4%

- Adults who did not receive stimulus: 14.7%

For more information, a detailed methodology, and complete results, you can find the original report on HireAHelper’s website: https://www.hireahelper.com/lifestyle/cities-that-needed-their-stimulus-checks-the-most/

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing – DONATE