The December 13, 2022 Consumer Price Index report had few surprises, at the headline and core level. Disinflation is occurring, albeit slowly. The S&P futures markets responded positively, seeing a window open for a Fed pivot and a growing, if small, possibility of a soft landing. Food prices are still edging up, but energy prices have declined notably. Used-car prices are sliding back toward pre-pandemic levels. But shelter costs, in particular rents, are continuing to rise rapidly and were the largest single contributor to this month’s CPI. As always, the devil is in the details. Prices associated with the year-end holiday celebrations, the most conspicuous of which are Christmas and Hanukkah, have risen precipitously since the start of the pandemic.

Below are the constituents of a proprietary index, termed HDAY, which tracks the equally weighted prices of CPI subindices (wage earners, not seasonally adjusted) associated with holiday spending. These include clothing, toys, books, software, and watches/jewelry. Pet-related consumption and personal care are likely to be consumed at this time of year, as are stationary, gift wrapping paper, postage and shipping services. Alcoholic beverages, confectionaries, indoor plants, and movie tickets round out the index. The table includes values for the ten-year change, the annual percent change, and the percent change since the end of 2019, shortly after which pandemic monetary and fiscal policies arrived.

| 10-yr pct | Avg ann’l | Pandemic | |||||

| Symbol | Constituent | Dec 2012 | Dec 2019 | Nov 2022 | change | pct change | pct change |

| CPGAWG Index | Women’s and Girl’s Apparel | 111.70 | 99.90 | 105.20 | 5.8% | 0.6% | 5.3% |

| CPGFSGSW Index | Sugar and Sweets | 212.10 | 218.70 | 268.30 | 26.5% | 2.7% | 22.7% |

| CPIQATTN Index | Admission to Movies, Theatres, & Concerts | 161.80 | 187.23 | 212.10 | 31.1% | 3.1% | 13.3% |

| CPIQSSGN Index | Stationary, Stationary Supplies, & Gift Wrap | 157.62 | 158.92 | 195.88 | 24.3% | 2.4% | 23.3% |

| CPIQCSAN Index | Computer Software and Accessories | 40.08 | 28.02 | 25.10 | -37.4% | -3.7% | 10.4% |

| CPWAMB Index | Men’s and Boy’s Apparel | 121.60 | 118.60 | 124.00 | 1.8% | 0.2% | 4.6% |

| CPWXABAN Index | Alcoholic Beverages at Home | 196.85 | 213.74 | 236.14 | 19.9% | 2.0% | 10.5% |

| CPWXCAUN Index | Cakes, Cupcakes, and Cookies | 267.57 | 287.26 | 359.70 | 34.4% | 3.4% | 25.2% |

| CPWXHARN Index | Haircuts and other Personal Care Services | 141.60 | 168.54 | 196.40 | 38.7% | 3.9% | 16.6% |

| CPWXINLN Index | Indoor Plants and Flowers | 131.16 | 136.51 | 159.29 | 21.4% | 2.1% | 16.7% |

| CPWXJEAN Index | Jewelry and Watches | 159.69 | 156.57 | 170.07 | 6.5% | 0.7% | 8.6% |

| CPWXPADN Index | Postage and Delivery Services | 157.66 | 194.02 | 223.44 | 41.7% | 4.2% | 15.2% |

| CPWXPETN Index | Pet Products and Services | 160.23 | 176.12 | 202.84 | 36.6% | 3.7% | 15.2% |

| CPWXRBKN Index | Recreational Books | 100.92 | 95.70 | 97.26 | 3.6% | 0.4% | 1.7% |

| CPWXTOSN Index | Toys | 52.49 | 30.44 | 29.71 | 43.4% | 4.3% | -2.3% |

| HDAY Index | 2178.4 | 2270.3 | 2605.6 | 19.6% | 2.0% | 14.3% |

Per the HDAY Index, prices of the selected goods and services have risen by over 14 percent since the holiday season just before the pandemic began. With the exception of two categories (software and toys) the average annual price change since 2019 has at least doubled. The largest price increases have occurred in clothing (mens, womens, boys and girls), gift-wrapping paper and stationary, jewelry/watches, and sweets (candy).

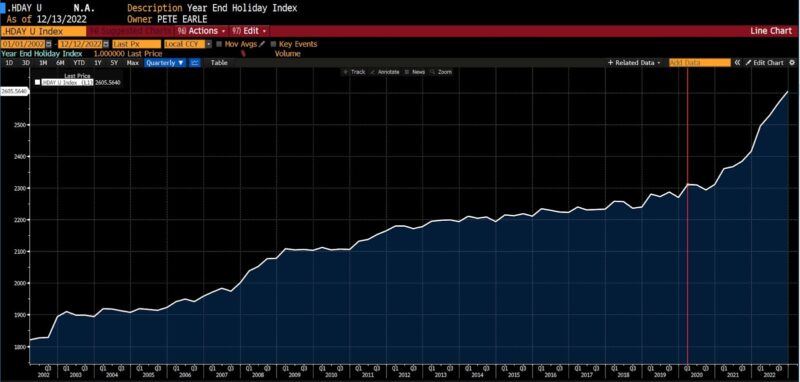

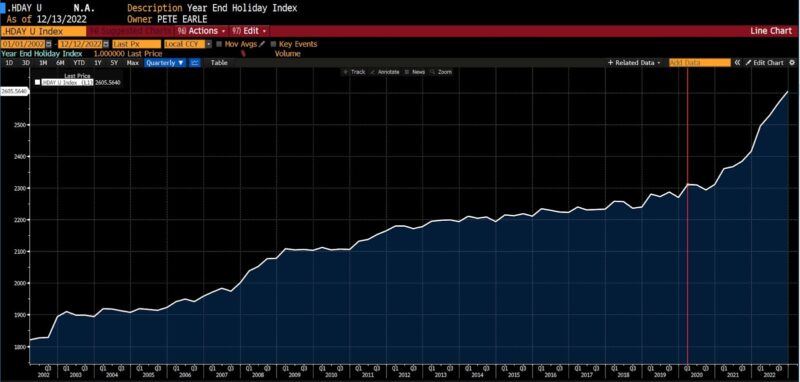

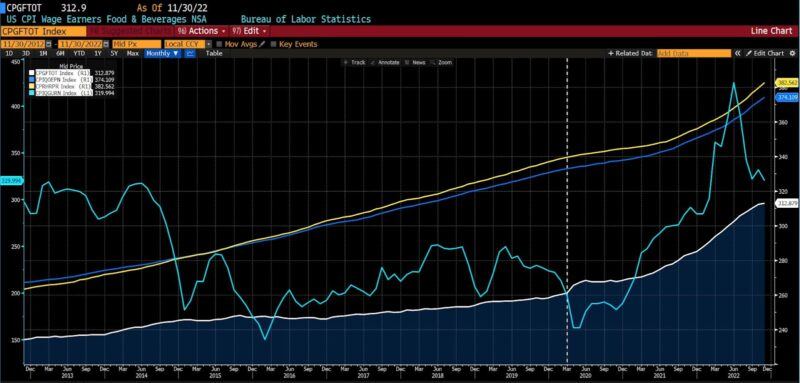

Price increases of just under 2 percent per year are, since the end of 2018, approaching 5 percent annually. A graphic depiction of the HDAY Index calculated from 2002 to the present is provided below, with a red vertical line indicating the start of pandemic policies.

HDAY Index (2002 – present)

All but the most credulous observers will note the “hockey stick” price inflection starting in late 2020, after trillions of dollars in fiscal and monetary stimulus was accompanied by quashed economic output.

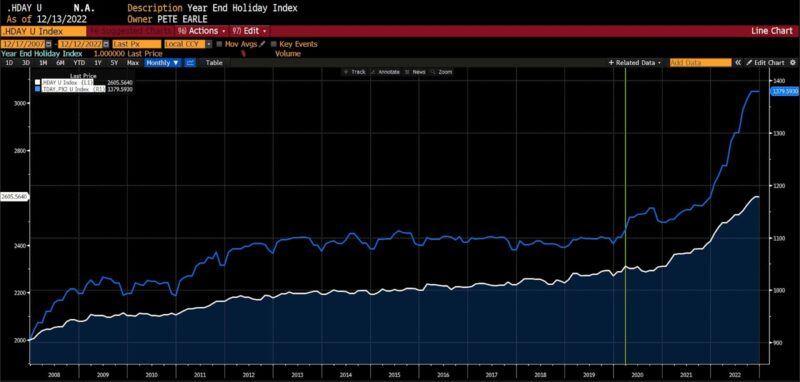

But the representation of the HDAY Index is incomplete without two prominent, additional expenditures: Christmas trees and public postage. In December 2019, the median cost of a real Christmas tree stood at $76.87. Estimates for Christmas tree prices this year range from $85 to $100, which taking a median price of $92.50 makes the pandemic-era price change just over 20 percent: roughly 6.7 percent per year. Artificial tree prices have soared to an estimated price of $122, undoubtedly reflective of rising costs to produce plastic (oil and natural gas prices, until June 2022, were at or near record-high prices) as well as exogenous factors.

The price of stamps, frequently overlooked, have taken a sharp turn upward as well. First class prices (first ounce) have risen from 55 to 60 cents since 2019, an increase of just under 10 percent. And the postcard rate has increased from 35 to 45 cents, an increase of over 25 percent. It bears mentioning that increases in the rate of snail mail hit lower-income and fixed-income individuals the hardest.

HDAY & TDAY Indices (2002 – present)

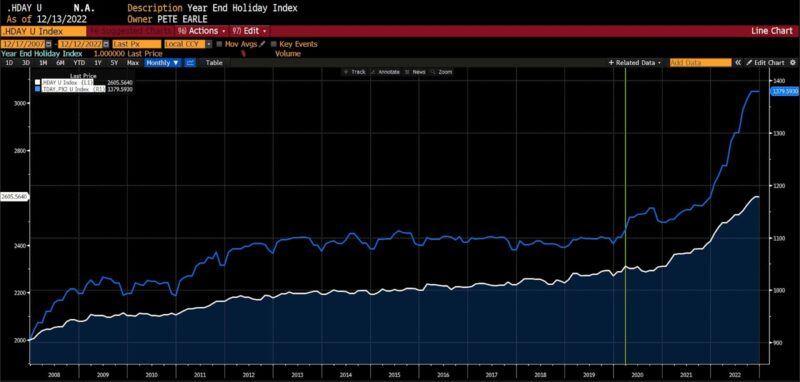

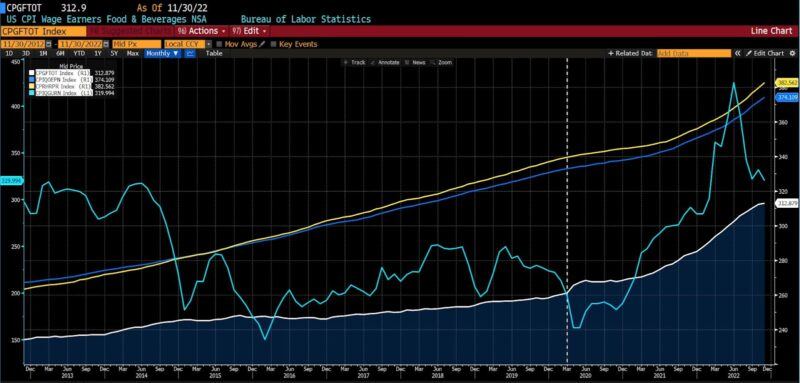

Additionally, in observing these trends in prices, one must remain aware that these two indices focus upon seasonal prices. Throughout this year, Americans have dealt with rising food and energy prices as well as financial market volatility. Above, the red line indicating the start of pandemic policies has been replaced with a green line to stay with a festive holiday theme. The ten-year trend of food, beverage, gasoline, rent, and owner’s equivalent rent (mortgages), below.

CPI Food & Beverages, CPI Unleaded Gasoline, CPI Owners Equivalent Rent, and CPI Rent (2012 – present)

The HDAY Index and TDAY Index lead to the same irrefutable conclusion: the ongoing cost of policies implemented to mitigate the spread of COVID are large and, almost three years later, proving disconcertingly persistent. Whether those tradeoffs were justified (particularly in light of recent revelations about politically-influenced social media censorship and growing evidence of bureaucratic corruption) remains for each individual to consider.

SOURCE

TELL YOUR FRIENDS ABOUT CITIZENS JOURNAL Help keep us publishing –PLEASE DONATE