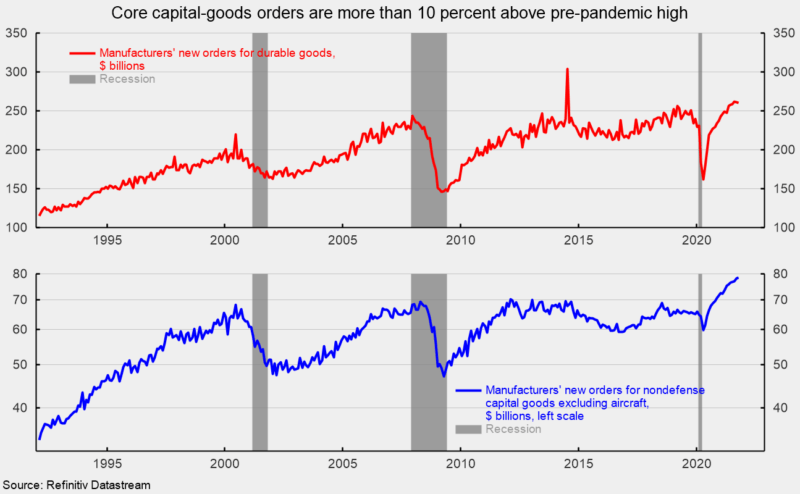

New orders for durable goods decreased in October, falling 0.5 percent, posting a second consecutive decline and the third drop in the last seven months. Total durable-goods orders are still up 14.6 percent from a year ago. The October drop puts the level of total durable-goods orders at $260.1 billion, still a strong level (see top of first chart).

New orders for nondefense capital goods excluding aircraft or core capital goods, a proxy for business equipment investment, rose 0.6 percent in October after gaining 1.3 percent in September, 0.5 percent in August, and 1.0 percent in July. Core capital goods orders have risen for eight consecutive months and 17 of the last 18 months, putting the level at $78.6 billion, another record high and the 11th new high in the last 12 months. Core capital-goods orders are about 12 percent above the $70.1 billion from February 2012, the previous record high from before the pandemic (see bottom of first chart).

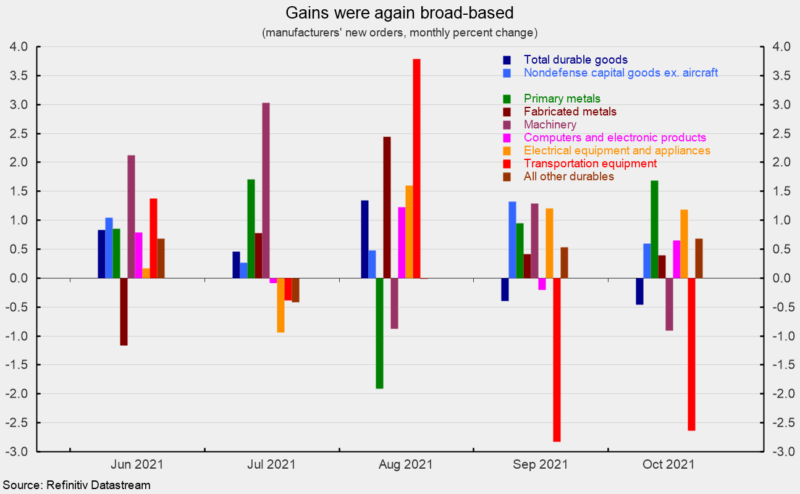

Among the categories in the report, gainers outnumbered decliners five to two. Among the individual categories, primary metals rose 1.7 percent, fabricated metal products gained 0.4 percent, computers and electronic products gained 0.7 percent, electrical equipment and appliances added 1.2 percent, and the catch-all “other durables” category rose 0.7 percent while machinery orders decreased by 0.9 percent, and transportation equipment sank 2.6 percent (see second chart). Within the transportation equipment category, motor vehicles and parts increased 4.8 percent as auto manufacturers try to rebound from ongoing chip shortages, but the gain was more than offset by nondefense aircraft which lost 14.5 percent, and defense aircraft which plunged 21.8 percent, the fourth decline in a row. From a year ago, every category shows a gain.

Durable-goods orders continue to be strong, particularly the core-capital goods components. Demand remains robust for the manufacturing sector, and the tight labor market creates incentives to substitute capital for labor. The pandemic may be accelerating structural changes to the economy, affecting labor, housing, manufacturing, and services. While ebbs and flows in new Covid cases can impact levels of economic activity, the outlook for growth is favorable. However, upward pressure on prices continues as demand outpaces supply. As labor, materials, and logistical issues are alleviated, price pressures are likely to ease, but the process may take a lengthy period of time.