- By Victor Skinner

(The Center Square) – North Carolina ranks among the worst nationally for how the state’s tax and regulatory rules treat remote workers, according to a new study.

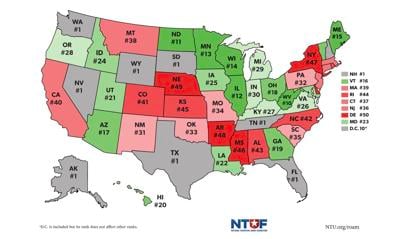

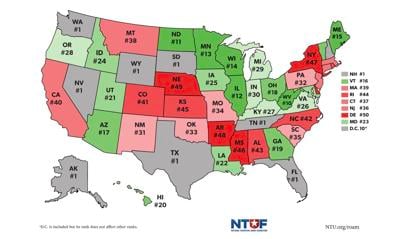

The National Taxpayers Union Foundation last week released its inaugural Remote Obligations And Mobility Index to rank every state based on how its laws and regulations treat remote workers.

The ROAM index analyzed five factors that apply to remote workers – filing thresholds, reciprocity agreements, “convenience of the employer” rules, individual tax burden, and withholding thresholds – then assigned every state a grade according to the metrics. Those metrics were then added to produce a final ROAM index score.

Overall, North Carolina ranked 42nd in the ROAM index, with a total score of 3.38 points out of a possible total of 35.

“Though North Carolina stays out of the very bottom states by virtue of its less burdensome overall individual income tax code, the Tar Heel State’s protections for remote and mobile workers are virtually nonexistent,” the report says. “North Carolina nonetheless has an opportunity to differentiate itself from the pack by instituting filing and withholding thresholds of greater than 30 days for employees and employers, and entering into reciprocity agreements with some of its high-traffic neighbors.”

The Old North State lost points because of its global wage threshold, which “looks at total income a taxpayer earns, not just income earned in-state,” according to the report.

The 30-plus day withholding threshold would only require taxpayers to file in-state after they work more than 30 days in North Carolina.

“This is the gold standard that all states should aspire to,” the report read.

North Carolina also does not have a reporting threshold for employers, which the foundation suggests should also be at least 30 days to ensure “that (businesses) will only face withholding obligations for employees who work a substantial amount of time” in the state.

For income tax code, the ROAM index used the individual income tax component of the Tax Foundation’s State Business Tax Climate Index, producing a score of 2.88 out of 5. The state received zeros for its lack of reciprocity agreements and convenience of employer rules. The convenience of employer metric assigned negative scores to states with the rules, which requires taxpayers who live and work in another state to pay income taxes to their employer’s state.

The worst state on the ROAM index is Delaware. Between North Carolina and Delaware at Nos. 43-49, respectively, were Alabama, Rhode Island, Kansas, Mississippi, New York, Arkansas and Nebraska.

“The states don’t break down in the typical red-blue partisan manner that many policy fights do,” the foundation said in a news release. “Some of the most liberal (New York, California) and most conservative (Nebraska, Arkansas, Mississippi) states nonetheless come out toward the bottom of the remote work rankings. And on the other end, states like West Virginia, North Dakota, and Illinois have some of the policy environments most friendly to remote workers.”

TELL YOUR FRIENDS ABOUT CITIZENS JOURNAL Help keep us publishing –PLEASE DONATE