“Something historic will happen this week” was how we started to explain the process by which the collapse of Evergrande could spread contagiously across the world this week.

One glance at global markets this morning suggests, at a minimum, that risk is being de-grossed across everything from European utilities to cryptos to US materials stocks.

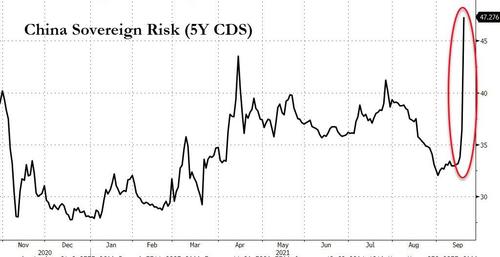

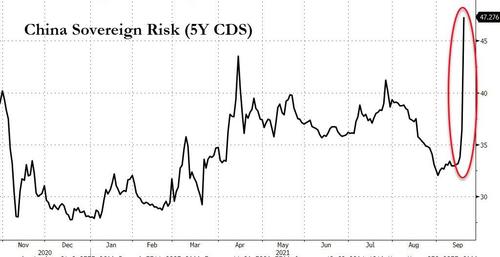

However, the biggest – and ultimate-est – contagion is that of China’s sovereign risk itself… and that is starting to blow out…

This sudden surge in default risk on China’s sovereign debt is very significant in the context of China’s constant reassurance to the rest of the world that it is solid-as-a-rock (just as Larry fink, but don’t ask George Soros). However, we do note that China CDS spiked to around 90bps in March 2020 (as the COVID crisis hit) and around 150bps in early 2016 (accelerating after China devalued the yuan in late 2015).

The question is, of course, where will this stop this time? How much ‘risk’ is China willing to take with its sovereign risk?

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing – DONATE