By Sheryl Hamlin

Santa Paula hosted a community meeting on August 5, 2019 at the Community Center. With chairs set for 80-100 people only about 20 were present. Council previously discussed the rates on the 17th of July, which was reported here.

On the dais were Public Works Director Clete Saunier, NBS Principal Greg Clumpner, City Engineer Thai Chau, Christy Ramirez Finance Director, and bond specialist Phillip Curls from Hilltop Securities.

In the audience were Ikani Tamaupeau Assistant City Manager, Michael Rock City Manager and Lucy Blanco City Clerk along with the film crew. The video and documents may be seen here. As of Tuesday evening, the video was not yet posted although the presentation was available. Others in the audience were citizens and press, including former Mayor Ginger Gherardi, Council Members Crosswhite and Sobel.

Finance Director

Christy Ramirez explained the involvement of the Finance Director in the Water and Sewer Enterprises. She indicated that much time was spent with customers so they are moving to a system which will streamline customer interaction. The Finance Department plans auto payments, pay by phone and an additional window to streamline services. The bill will be reformatted, she said.

She also noted the document here for the 2012-2013 rates. Document. Water billing, she said, is the most complicated due to meter size.

NBS Presentation

Greg Clumpner explained that the NBS data extends 20 years but for Proposition 218 purposes can only be shown as five years. He explained nuances in the Proposition 218 litigation particulary the San Juan Capistrano case. Rate revenue occurs by customer type, he said, in fixed and volumetric rates.

The Methodology

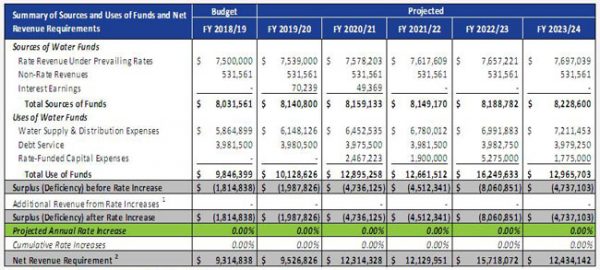

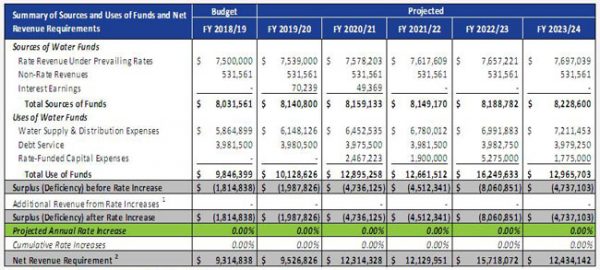

It is important to understand that NBS started with a Profit and Loss Statement (P&L) for both Water and Sewer Enterprise using existing operational data and bond payments with no rate imcreases. These P&L charts are shown below. Note the steep negatives with no rate increases.

Sewer P&L

Water P&L

NBS called this the Alternate 1 or “no rate increase option”.

Options 2 and 3

Rather than attempt to bring either of the two “as-is” pro forma into stasis or balance, the consultant came up with two alternatives of different rate increases showing the effect of these rate increases on the Bond Covenant, which requires revenue to be 1.2 times the bond payments, and capital reserve balances.

The Alternatives Water

Alternative #1 – No Rate Increases (the results if the City makes no changes to rates).

Alternative #2 – 15% Annual Rate Increases for the next 5 years.

Alternative #3 – Rate Increases to Meet Debt Coverage Ratios.

Alternative #4 – Issuing $15 million in Revenue Bonds (in FY 2020/21) and Delaying three CIP Projects.

The Alternatives Sewer

Alternative #1 – No Rate Increases (the results if the City makes no changes to rates).

Alternative #2 – Inflation-Based Rate Increases for the next 5 years (3%/year).

Alternative #3 – Issuing $20 million in Revenue Bonds (issued in FY 2020/21)

Alternative #4 – Use Separate Funding for Recycled Water Distribution System.

Discussion

The consultant said that Alternate 2 and 3 in Water included “restructuring debts” taking advantage of lower interest rates. There is a balance of $46 million in bonds payable at the current time, so if the Water Capital Improvement projects were added, the total new bonding would be an additional $21 million per the current capital plan. See Fund 620 here.

Sheryl Hamlin questioned the additional bonding debt. City Manager Rock responded that he was opposed to more debt, although it was clearly an option considered by the consultant.

Note that Alternative 4 has been removed in an updated posting of the presentation on-line.

Capital Expense and Projects Funding

An audience question was submitted about the funding of the reserves. The consultant said that any excesses at year end would be moved to reserves. Thus, the reserve fund was defined simply as revenue over expenses. It is this reserve fund that would be used for capital expenses and capital projects, according to the consultant, as well as additional bonding. So, if this is the case, why would there not have been a P&L chart for each of the options showing the contribution to reserve?

Sewer More Straight Forward?

The Consultant continued to promote the idea that 1) there is a viable “water recycling project” and 2) it will only cost $15,000.000. Read about the pipeline to Limnoneira here.

Note that Alternative 4 in Sewer includes a separate funding mechanism (as yet undefined) for this “water recycling project”. In conversation, City Manager Rock asserts that Limoneira will bear the cost for this project as well as an annual fee for the water. Both Clumpner and Rock seem to misunderstand that the highly chloride laden effluent from the Santa Paula Wastewater plant will require millions of dollars of treatment before Limoneira can use the water for agriculture.

Citizen Comments

Former Mayor Gherardi spoke about the data used in the report and about the operation of the wastewater plant. First she said that NBS did not use correct numbers of household in the report. East Area 1 should be higher and sewer costs will remain the same. In fact, she said that the sewer plant was sized to support Fagan and Adams, so the city should be looking at customers to utilize this excess capacity. She said that council listened to bond sales people previously but the ratepayers received only one rebate. She suggested finding a grant for the $15 million “water recycling project” aka ‘pipeline’ to Limoneira’s west county property. She said the “admin billing fee’ should be removed because citizens have been paying for this plant for years. She suggested a comprehensive look at all debt service. The sewer operational costs are excessive by at least 5% and the city must get control of this plant. She has not been happy with either of the two plant operators. Read about the acrimonious selection of the previous plant operator.

Pam Marshall said there should have been handouts. Note the material can be downloaded here.

Pat Novack presented a 2013 letter from former City Manager Jaime Fontes saying “Today we are still struggling to deal with cost of indebtedness and bonded indebtedness associated with the construction of our new sewer plant and aging water infrastructure.” Note that this letter was sent to all customers prior to the purchase of the waste water plant.

Read about the plant history here. Important history.

What did We Learn ?

The consultant favors Alternate 3 in both cases. He said so explicitly. Sewer includes revenue bonds and water includes increased rates to fund reserves for capital. He said so explicitly. City Manager Rock and City Finance Director are both concerned about more debt and have spoken to this in meetings.

Without a bond offering or a grant, the chloride mitigation for the wastewater plant will not occur and be kicked down the road again like it has been since 2004. Read about that history here.

Rates will rise but there is not an obvious correlation of the new rates to the actual cost of operation because the consultant did not provide pro forma for these alternatives which is a requirement of Proposition 218.

Schedule

August 21, 2019 Council Workshop

August 5 – September 4 Public Review

Proposition 218 Review September –October 2019

Rates Effective November 2019

For more information on author click sherylhamlin dot com

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing –DONATE